AN INVESTMENT FOR TODAY'S TAX-CONSCIOUS INVESTOR

Tax-exempt municipal bonds are among the most popular types of investments available today,

and with good reason; they offer a wide range of benefits, including:

-

Attractive current income free from federal and, generally, state and local taxes;

-

Wide range of choices to fit your investment objectives regarding credit quality, maturity, type of issuer, type of bond and geographic location;

Under present income tax law, the interest income you receive from municipal bonds is generally free from federal and state income taxes.( Generally interest income received from securities issued by governmental entities of a state is exempt from state and local taxes for residents of the state of issuance.) Capital gains on municipal bonds are taxable.

In addition, interest income from securities issued by U.S. territories and possessions is exempt from federal, state and local income taxes.

If you are a resident of: CA, FL, GA, MA, MI, NV, NY, RI, TX, or WA . I would be happy to provide more information on municipal bond investments

For more information please call or E-Mail to:

Ezra Sasson, Investment Executive (800) 765-2200 or (323) 658-4400 ext. 1336 E-Mail: sassone@mlstern.com

Securities offered are subject to prior sale and/or change in price. Some bonds are subject to alternative minimum tax (AMT)

Bonds sold prior to maturity are subject to market and price fluctuation you may receive more or less than you originally paid.

Bond prices generally decrease as interest rates rise.

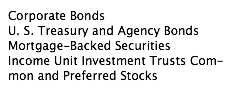

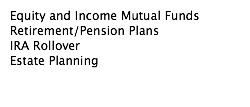

We can also provide you information about other income and growth investments, including;

Member: NASD & SIPC

Member: NASD & SIPC